Investment Structure

The Scheme’s investment objective is to achieve investment returns that ensure the assets of the Scheme are sufficient to meet each member’s benefits and the Scheme’s expenses as they fall due over time.

Statement of Investment Principles

The Scheme’s strategy and objectives, together with full details of the investment process are set out in the Statement of Investment Principles. This document is updated regularly and a copy is available here.

Investment strategy

The Trustee aims to secure members’ future benefits by reducing risk and delivering consistent, reliable investment performance.

The Invensys Pension Scheme is a mature scheme. On 31 March 2015, the Scheme closed to future accrual. All active members became deferred members, and the Scheme stopped receiving ongoing contributions from the active membership. The Scheme is a substantial net payer of benefits. The payment of these benefits therefore erodes the asset base of the Scheme naturally every year. One measure of the extent of a scheme’s maturity is looking at the net payments made by the scheme each year as a proportion of the scheme’s assets. Approximately £241m, equivalent to 8% of the Invensys Pension Scheme’s asset base, was paid out in the year to March 2025.

IMPLEMENTATION OF THE Scheme’S investment strategy

The Scheme’s investment objective was changed in November 2024, when the discussions on the Scheme’s Triennial Valuation as at 31 March 2024 concluded. The Scheme’s new investment objective is to achieve a return on investments equivalent to UK government gilt yields +0.85 percentage points per year across the full value of the assets, including any surplus, over the term until 30 September 2027. After that the objective reduces to the return on gilts +0.75 percentage points per annum. This is also referred to as the Strategic Target. This new Strategic Target is 0.35 percentage points higher than the discount rate that is used to calculate the Scheme’s Technical Provisions.

The Trustee’s investment policy is designed to achieve the Strategic Target. In order to deliver gilts +0.85 percentage points per year, the Trustee has to invest in assets that have an element of risk associated with them. The risks, and the framework for managing them, are described in detail in the notes to the financial statements.

The main factors that the Trustee considers when setting the Strategic Target are:

the Scheme’s profile:

the nature of the liabilities

the structure of the membership base

the Trustee’s overall risk tolerance

the Trustee’s evaluation and perception of the covenant provided to the Scheme.

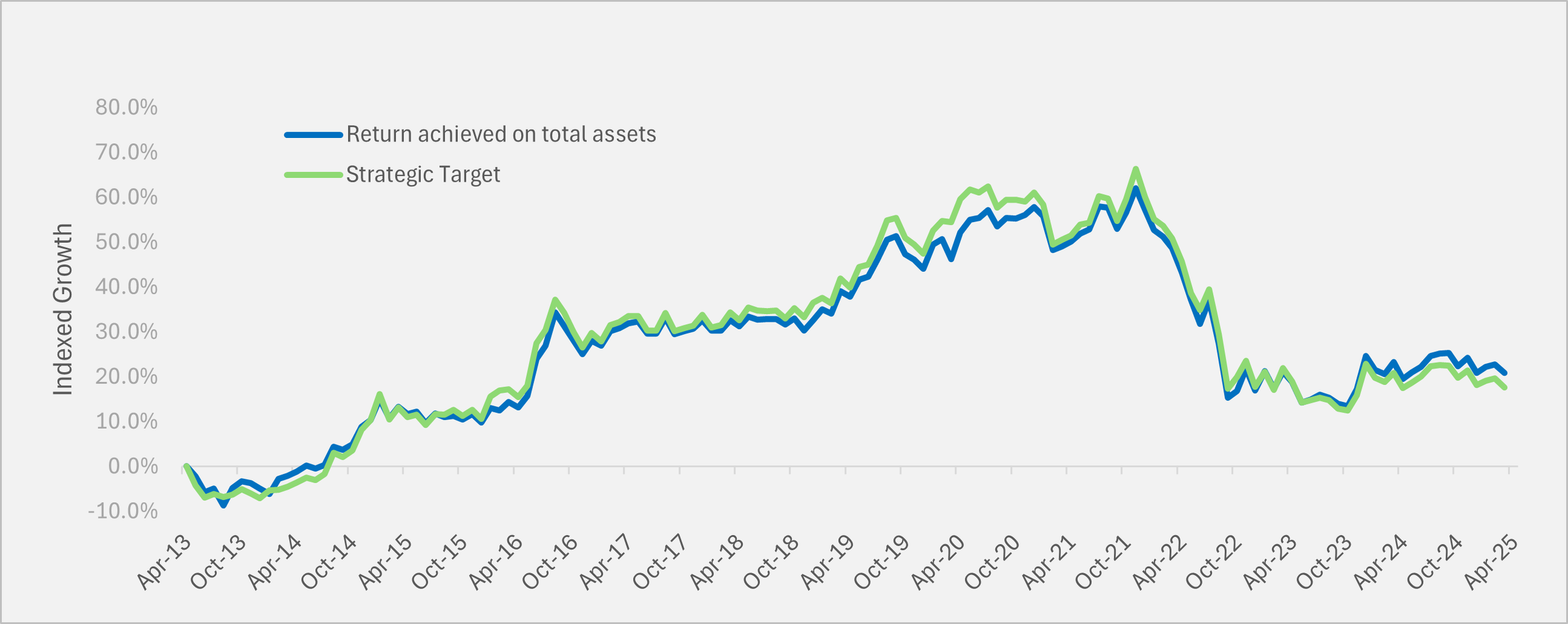

From the Strategic Target, the Trustee derives a Strategic Asset Allocation. This was designed to deliver asset returns of gilts +0.85 percentage points per year, and therefore to perform in excess of the liabilities measured on a Technical Provisions basis by 0.35 percentage points per year. Prior to April 2022, the Strategic Target and return implied by the Technical Provisions were equal. The chart below shows that the Scheme assets’ performance has tracked the Strategic Target very closely over time and now exceeds it. The performance deviated from the Strategic Target in Q1 2020 as a result of large adverse market movements following the start of the COVID-19 pandemic. The cumulative asset performance has caught up with the Strategic Target since then. This performance during the financial year is further explained below. The chart starts from the end of April 2013, which coincides with the £400m contribution paid into the Scheme on 3 May 2013 and the creation of a Reservoir Trust of £225m following the sale by Invensys plc of its Rail division. At that time, the investment strategy was revisited and the Trustee took the opportunity to seek to reduce investment risks.

The Return on Total Assets has exceeded the Strategic Target over one year by 0.7 percentage points and over three years by 1.3 percentage points per annum and over five years by 1.6 percentage points per annum, thus contributing to an improvement in the Scheme’s funding level.

The Trustee determines the investment strategy after taking advice from a professional investment adviser. The investment strategy and objectives, together with details of the investment process, are set out in the Statement of Investment Principles. This document is updated regularly. A copy is available on the Scheme Documents page.

Strategic asset allocation

To a large extent, the Trustee has invested in assets with a profile that closely matches the Scheme’s liabilities by using bonds or ‘bond-like’ assets. This approach helps the assets to match the valuation movements in the liabilities, thereby reducing the volatility of the Scheme’s funding position.

The Scheme’s investments are classified in two categories:

1. A Liability Matching Fund (LMF). This is used to mitigate the Scheme’s interest rate and inflation risks. The LMF is composed primarily of assets perceived to have a relatively low risk:

UK Government gilts

Network Rail bonds

cash

cash equivalent instruments

BlackRock, the asset manager managing this portfolio, is also permitted to use derivative instruments, such as interest and inflation swaps, and gilt repurchase agreements. The LMF which represented 53.0% of the Scheme’s assets at 31 March 2025, is held directly via the Scheme’s custodian platform with the Bank of New York Mellon.

2. An Investment Portfolio. This aims to access the risk premium of a diversified portfolio of return-seeking assets. It also seeks to benefit from the additional performance available from active management, where considered appropriate. The total Investment Portfolio represented 45.6% of the assets at 31 March 2025.

Mandates using primarily investment grade (IG) bonds made up 40.3% of the assets and were managed by:

AXA

M&G

Amundi

The remaining 5.3% in the investment portfolio comprised:

a broad bond portfolio (Amundi)

a loans mandate (M&G)

a fund investing in bank regulatory capital release transactions (AXA PCS)

1.4% of the Scheme’s assets relate to cash held to satisfy the Scheme’s short-term payment obligations or pending investment and other net current assets.